Abstract

There has been such a huge increase in demand for containing healthcare costs which has led to the evolution of pharmacy benefit management (PBMs). The PBMs are responsible for implementing drug formularies, negotiating rebates from manufacturers and these formularies have been relatively inclusive but are seen to have become more restrictive over time. We have tried to bring to you in this article the evolution of PBMs, key roles played by PBMs in drug benefit management, how they apply innovative strategies in order to reduce costs, emerging trends in drug business management, challenges faced by the segment, the role of PBMs in the changing health care environment and other such crucial and critical areas.

US healthcare system and its management of prescription drugs

One of the interesting aspects of US health care system is its expertise in terms of delivery of multi various lines of healthcare. Since the late 70s there has been a great evolution in the management of prescription drugs which has been seen as a separate entity and a line of business. There has been great focus on the drug costs and respective insurance coverage with regards to the understanding of the functioning of the PBMs. Prescription drug costs have accounted for 10% ($2.6 trillion) of US Healthcare spending in 2010, which is a substantial amount with an increase in growth with every passing year.

Evolution of PBM

PBMs as we have mentioned, date back to the 70s, when the idea of drug cards became common and an add-on to the then existing union medical benefit program. PBMs have its roots in claims administration and as there has been an increase in the prescription drugs coverage in the private sector, insurance companies have been facing the difficult and daunting task of managing a large volume of relatively small value claims efficiently and economically. With more and more employers getting into the drug benefit scheme, PBMS began to construct information technology competencies and know-how in order to enable the automation of the drug claims. In the 1980s full-service PBMs became independent and began to function on their own, seeing a growth in revenue in the next 10 years. In the US alone, there are around 70-100 full-service PBMs operating with the number in variance depending on the acquisitions and mergers. The PBMs come in all shapes, structures and sizes and they can be private, publicly traded or even not-for-profit organizations. The well-known PBMs are UHG, Aetna, Cigna and a few subsidiaries of major drug outlets and retail stores (eg. Walmart, Walgreens). There are a few systems companies like SXC Health Solutions and claims adjudicators like Argus Health Systems which have PBM divisions too.

Consolidation of the PBM Industry – how has this happened?

● As of 2013 72% percent of market was controlled by TOP 3 PBMS

● Record profits shown by leading industry PBMs with stocks trading at all-time highs

● There is $284 billion market and many PBMs are anxious to capture a piece of this

● The arena of independent Rx advisors is reducing and leads to employer Rx spend being excessive.

Scope of PBM’s in Obamacare

In light of what has happened to PBMs in 2013, what can Rx manufacturers expect from Obamacare?

- PBMs in Obamacare for insurers will be responsible for accumulating the buying power of millions of fresh enrolments.

- Result would be that Obamacare patients will receive lower prices for drugs as the PBMs are known to drive the Rx manufacturer discounts – how do they achieve this – fee reductions from retail pharmacies; step-up in utilization of mail-order pharmacy; rebates on pharma manufacturers.

What about the competition among PBMs?

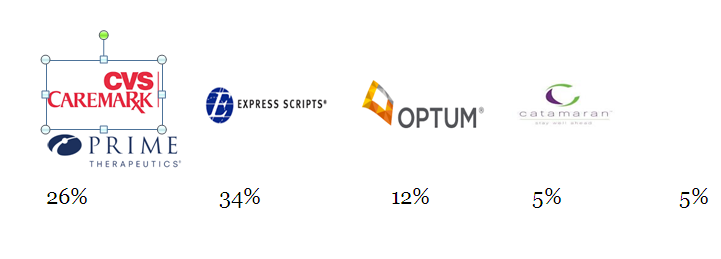

Competition among PBMs will become very high. The so called “BIG Five” PBMs in Obamacare (Express Scripts, CVS Caremark, Prime Therapeutics, Optum Rx, and Catamaran) will wage a battle in their desire for PBM dominance just as we see happening in all private and public insurance markets.

Each of the Big Fives is dedicated to a different insurance provider:

- CVS Caremark works exclusively with CVS retail chain pharmacies

- Optum Rx is linked directly to United Health Care

Thus each of them having varying approaches to the way they deal with Rx manufacturers, as each has a different objective.

Whatever may be the individual objective of each PBM, the collective goal is only that of driving down cost of Rx services.

How is each PBM to be differentiated?

The Big 3 – Express Scripts, Medco Health Solutions and CVS / Caremark – are not just sitting back and simply enjoying their dominance. They are constantly looking at different business strategies and pursuing them with rigour to ensure that they remain ahead of the rest of the competition and industry. They remain the dominant factor in terms of deciding prices and hence every prescription continues to depend on them.

“There are hence many models emerging” says Steve Miller, MD of Express Scripts. Steve Miller says that his company is taking a behaviour-centric approach and thereby they are developing a unique forte for themselves. They are becoming experts in consumer behaviour as regards medication. Their goal therefore is to influence consumer behaviour to promote optimal use of medicines from the point of quality and cost.

Providing Face Time – CVS / Caremark

CVS / Caremark – the other one among the Big 3 – they have put their bet on the retail segment. “Driving business from the front doors of their pharmacies” – that’s the goal of Caremark. The one missing factor in pharmacy services is the face-to-face interaction between the pharmacist and patient. Encashing on this lacunae, CVS promotes this – how does CVS achieve this - by providing face time. Steps taken towards this -

-

Implementing a “Maintenance Choice” as a program CVS allows patients to pick up their 90-day prescriptions at any CVS store instead of receiving them by post.

-

Speciality medication can also be bought at the pharmacy, where the pharmacist will be available to answer questions and show you how the drug is administered.

● CVS now has 520 stores after it boosted its store strength strategy with the acquisition of Long’s Drug Stores along with Rx America, a PBM with 8 million members.

● The PBM now also has 4, 50,000 Part D members in its CVS Medicare membership.

Model PBM Markets under Obamacare

While the details of the operation of Obamacare PBM is not known, one should also look to other insurance markets for understanding and insights into the market. In particular, the PBMs in the Medicare Part D marketplace and Rx services that are an offering by PBMs in new private health platforms will provide an insight into the PBM offerings from Obamacare.

“What is the impact of PBMs on Private Health Exchanges”

● Private Health Exchanges resemble insurance concept of Obamacare to a very large extent.

● There are several large entities such as (IBM, Walgreens, GE and others) which plan to migrate their employees out of the health insurance plans to “defined contribution” programs. This can be achieved by private health exchanges. What are these private health exchanges?

● Some are the “self-insured” model which provide healthcare to individuals while most others offer group health insurance to employers within a “fully insured” model.

● The common objective of both models is to reduce the cost of healthcare to the employers.